First half 2024 on track – 2024 guidance confirmed

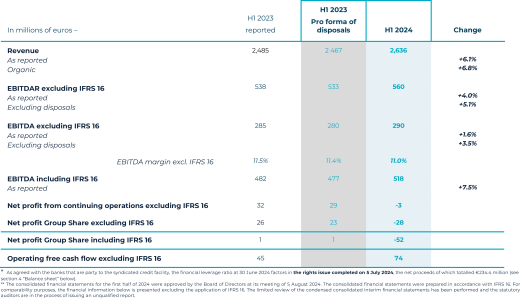

- Revenue increased by 6.8% in organic terms in the first half of 2024, supported by all businesses and re-gions with notably a nursing home occupancy rate at 90.5% in June 2024, up from 88.3% in June 2023. Over the first half as a whole, the average occupancy rate was 89.5% (excluding the United Kingdom), compared with 87.9% in the first half of 2023.

- EBITDA, excluding IFRS 16 and disposals, rose 3.5%. As anticipated, the margin was down only slightly due to the strong reduction of the real estate development business. Excluding this effect, the margin would be up by 75 basis points, reflecting the tight grip on operating costs and the initial effects of the recovery in Germany. EBITDA including IFRS16 is up 7,5%, on a published basis, compared with the first half of 2023.

- The Group made a net loss of €3 million from continuing operations excluding IFRS 16, including notably the impact of the interim financing costs put in place in anticipation of the capital increase and disposals in the first half; net profit, Group share excluding IFRS 16, at -€28m, includes the loss on the disposal of the serviced residence business in France in June 2024.

- Operating free cash flow excluding IFRS 16 rose sharply to €74 million, versus €45 million in the first half of 2023.

- The Group made good progress with its plan to strengthen its financial position:

- Successful capital increases raising a total gross amount of €329 million, with the rights issue being 168% oversubscribed.

- Disposal programme well underway with around 40% of the total amount secured during the period out of an expected total of €1 billion to be raised by 2025.

- The financial leverage ratio improved by 50 basis points, falling to 3.6x* versus 4.1x at 30 June 2023, and 3.8x at 31 December 2023, and the LTV was 63% versus 58% at 30 June 2023 and 61% at 31 December 2023; this transitory increase in the LTV is due to the low level of debt in the portfolios sold (mix effect) and due to higher capitalisation rates.

- The Group reached new milestones in terms of achieving its ESG roadmap targets, including validation of its greenhouse gas reduction trajectory by the SBTi.

- The Group is confirming its 2024 objectives: organic revenue growth of over 5% and EBITDA at least stable excluding IFRS 16 and disposals.

Sophie Boissard, CEO of Clariane, said: “Through the dedication of all Clariane employees, for which I am grateful, and the relevance of our business model based on a diversified portfolio of businesses and geographical markets, Clariane achieved a solid performance in the first half, particularly in Germany, where we are seeing the initial impact of our plan to restore margins.

More than ever, we remain focused on fulfilling our mission of caring for fragile people and on implementing our non-financial commitments, both social and climate-related. The SBTi has validated our greenhouse gas reduction targets and we are having regular constructive discussions with our Mission Committee, which published its first report on its work in April.

I am delighted that we have already been able to complete three of the four key components of our plan to strengthen our financial position, which we began on 14 November 2023. In particular, the capital increases we carried out in June have bolstered our shareholder group, with the arrival of HLD Groupe and increased stakes for Flat Footed and Leima Valeurs, alongside our long-standing shareholder Crédit Agricole Assurances. We are actively working on completing our €1 billion asset disposal plan, of which we secured 40% in the first half of 2024. This final component of the plan will enable us to hit our 2025 debt reduction targets.

Buoyed by our achievements and the momentum resulting from our ‘At Your Side’ corporate project, we are looking ahead to the second half of 2024 with confidence and determination.”

Important information

This document contains forward-looking statements that involve risks and uncertainties, including those included or incorporated by refer-ence, concerning the Group’s future growth and profitability that could cause actual results to differ materially from those indicated in the forward-looking statements. These risks and uncertainties relate to factors that the Company cannot control or estimate precisely, such as future market conditions. The forward-looking statements contained in this document constitute expectations of future events and should be regarded as such. Actual events or results may differ from those described in this document due to a number of risks and uncertainties de-scribed in Chapter 2 of the 2023 Universal Registration Document filed with the AMF on 30 April 2024 under registration number D.24-0380, as amended (i) in section 3 of the amendment filed with the AMF on 31 May 2024 under number D. 24-0380-A01 (the “First Amendment”) and (ii) in section 2 of the amendment filed with the AMF on 12 June 2024 under number D. 24-0380- A02 (the “Second Amendment”) available on the Company's website (www.clariane.com) and that of the AMF (www.amf-france.org). All forward-looking statements included in this doc-ument speak only as of the date of this press release. Clariane S.E. undertakes no obligation and assumes no responsibility to update the in-formation contained herein beyond what is required by applicable regulations.

Readers are cautioned not to place undue reliance on these forward-looking statements. Neither Clariane nor any of its directors, officers, employees, agents, affiliates or advisors accepts any responsibility for the reasonableness of any assumptions or opinions expressed or for the likelihood of any projections, prospects or performance being achieved. Any liability for such information is expressly excluded. Nothing in this document is, or should be construed as, a promise or representation regarding the future. Furthermore, nothing contained in this document is intended to be or should be construed as a forecast of results. Clariane’s past performance should not be taken as a guide to future performance.

In this press release, and unless indicated otherwise, all changes are stated on a year-on-year basis (2024/2023), and at constant scope and exchange rates.

The main alternative performance indicators (APIs), such as EBITDA, EBIT, net debt and financial leverage, are defined in the Universal Registration Document available on the company’s website at www.clariane.com.